The budgeting phase for the 2025 financial year should actually be completed by November. However, the reality is that many companies, even smaller ones, only prepare their annual budgets towards the end of the year. A well-structured process and clear planning make budgeting much easier. Annual comparisons also provide important additional insights into the development of turnover or allow trends such as rising purchase prices to be recognised at an early stage.

Budgeting process and planning

The best time to start the budget for the following year depends on the size of the company as well as the industry. Generally speaking, the classic budgeting phase begins in September. At the same time, the 3rd quarterly report is available in October. This means that reliable forecasts can be made for the 4th quarter and therefore the entire current financial year, but also that initial trends for the new year can already be derived. The new annual budget should be ready in November so that it can be placed on the agenda for the last meeting of the Board of Directors at the latest. In the case of a larger company or one with a long-term planning horizon (e.g. in purchasing), budgeting should already begin in the summer.

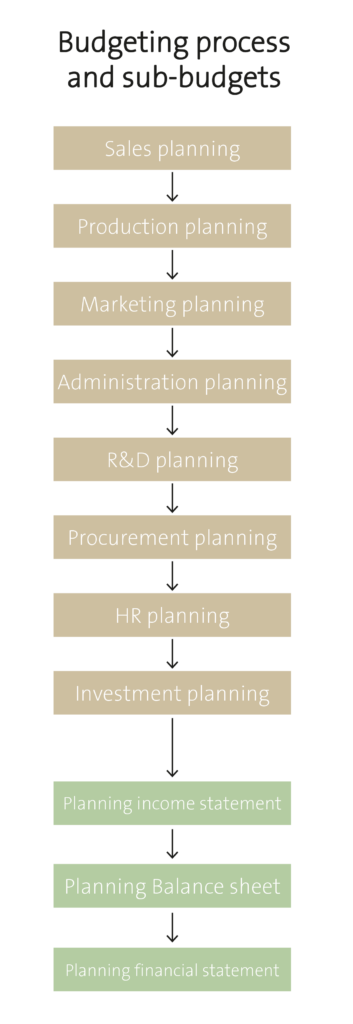

A careful process with milestones and a structure with clear tasks is highly recommended so that the budgeting process does not run into bottlenecks and all departments can deliver their sub-budgets and KPIs on time. The sub-plans of a budgeting process can be summarised as follows:

Different factors for manufacturing and service companies

As mentioned above, the industry and business model is an important aspect in determining the correct budget items on both the income and expense side. Is revenue generated through billable hours or through the sale of products? Can turnover be planned or, as in typical project management, can it only be estimated for the next 3 to 6 months? Accordingly, it is also worth operating with scenarios and having possible measures up your sleeve in case turnover collapses or increases rapidly.

On the expense side, the most important budget items for service companies are almost always wages or the utilisation of personnel capacities and IT expenses. For manufacturers, industrial companies or food producers, rising purchasing and production costs are relevant, for example energy prices or inflation – as has been the case in recent years – are key external factors that need to be taken into account.

Forecasting, controlling and annual comparisons

Due to the ever-increasing demands on the agility of companies, internal processes such as budgeting and controlling must also be adapted to operational realities. Accordingly, it is worth introducing or switching from static budget planning to rolling budgeting. Budgeting is therefore less of an annual, one-off task and more of a continuous process. A review every three months or even monthly enables rapid reactions to be implemented in the operational business and reduces the risk of unpleasant surprises at the end of the year.

If this process is followed over several years and the structure remains standardised, direct and meaningful annual comparisons and forecasts can be created. Such annual comparisons are particularly valuable for companies with little planning certainty or a highly seasonal business. Accordingly, better resource planning can be created, for example with regard to personnel capacities. All the important data, summarised in a clear dashboard, also allows management or the board of directors to be informed quickly.

Budgeting processes are complex, but can reveal important insights if implemented optimally, and forecasting also enables agile action. At Experfina, we have many years of experience in budgeting in a wide range of industries and company sizes. Contact us for external support or, if required, for a more comprehensive mandate.